Chapter 9 – Want to Buy a House?

These mini-money guides are based on the practical money book "You're Not Broke You're Pre-Rich" by Emilie Bellet.

The statistics are not encouraging. Homeownership among 25 to 34 year olds has plummeted in the UK over the past few years. It’s hardly surprising, given the insane rise in house prices, coupled with the ‘Why even bother?’ attitude that many young people have now adopted in the face of these huge increases.

But it is possible to get on the ladder, thanks to government help and a bit of financial savvy. Buying a home isn’t just a financial decision - probably the biggest one any of us make - but an emotional one, too. So we need to go into this with a can-do attitude.

The earlier you start preparing to buy, the better. This includes building up your credit score to impress mortgage lenders, scoping out an estate agent or mortgage broker you get along with and researching the housing market on sites like Zoopla.

And of course, saving. Research shows millennials will take on average around 20 years to save for a deposit, compared to three years during their parents’ generation. (No wonder it was estimated 27% of buyers in 2018 got the deposit from the bank of mum and dad.) The more you can save to put towards your deposit, the less you borrow, and the less you borrow, the less you’ll pay in interest. But it’s not about scraping together the biggest deposit you possibly can - you want to retain a financial buffer for the fees and moving costs that we will go into later.

There are government-backed schemes which can help you save. With the Help to Buy and the Lifetime ISA, the government ‘tops up’ your savings with a tax-free bonus, and the Help to buy shared ownership scheme means you can purchase a smaller part of the property and pay rent on the rest. These schemes are normally for first-time buyers and come with certain conditions, like how old you have to be, what you can buy (usually a new build), how much income you have and the highest value of the property you can buy, depending if it’s in London.

There are also different types of mortgages - from fixed and variable rate, to interest only-and repayment, as well as buy-to-let. We will explain them in detail, as well as how to apply for them.

Whatever type you get, always shop around for the best deal and understand what mortgage you’re buying (people tend to do more research when buying a car of going on holiday!). And if you’re going into homeownership with a friend or a partner, it has to be someone you trust, because once you’re both on the mortgage, your credit scores are intertwined too.

Beware of ‘hidden’ fees - it’s not all about the deposit. Between legal fees, fees on the mortgage or mortgage broker, getting a home survey to check for things like damp or a leaky roof, signing up to the land registry and moving-day costs, you’re looking at at least several thousand pounds. Have you also saved for that?

Buying a home can be a mega-stress inducer with false starts and disappointment along the way, and it’s only natural that when we do finally buy a property, we wonder if we’ve made the right decision. But now it’s time to be positive: you have the keys. Celebrate your achievement - and learn how to assemble those flat pack wardrobes.

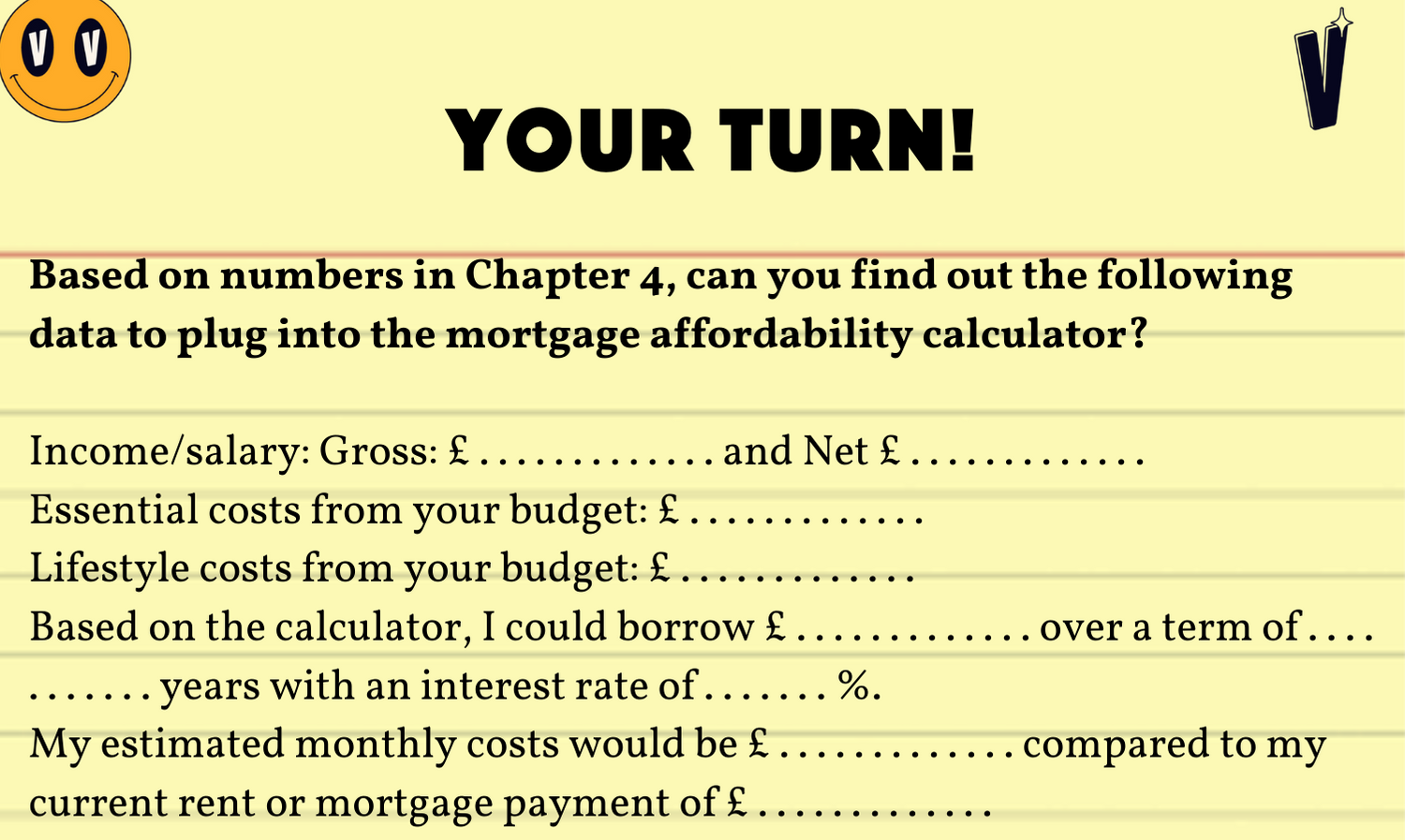

Use the Money Advice Service calculator to find out how much you might be allowed to borrow:

JOIN THE COMMUNITY!

Get our weekly newsletter and check our future events here.

If you want to learn more about the book and see a few photos from the book tour, it’s here. You can order "You're Not Broke, You're Pre-Rich" on Amazon and if you’ve read the book and enjoyed it, I will be forever grateful if you could review it on Amazon or Goodreads.

DISCOVER MORE CONTENT FROM THE BOOK

Chapter 2 – Get Real With Your Money

Chapter 3 – Planning For The Future

Chapter 4 – Own It: Get A Grip On Your Money

Chapter 5 – Asking For More £££

Chapter 6 – Navigating Your Bank Balance

Chapter 7 – How Does Investing Work?

Chapter 8 – Investing in The ‘Stock Market’

Chapter 9 – Want to Buy a House?

Thank you, Emilie