Surviving the Dotcom Bubble with Martha Lane Fox of Lastminute.com

Surviving the Dotcom Bubble with Martha Lane Fox of Lastminute.com

The Wallet podcast is back, and we’ve got something new in store for you. You’re familiar with our interviews with financial experts, money enthusiasts, and top investing lessons, but we decided to spruce things up a bit and do something different. Over the next 6 weeks, we’re introducing a series titled 'Banking Bad' - an entirely new format! Get ready for tales of socialite financial abuse, debt struggles, gambling addictions, the rollercoaster world of meme stock investors, and true financial crime stories.

In this episode, I speak to Martha Lane Fox, the co-founder of lastminute.com, Europe’s biggest travel and leisure website. She started the company in 1998 with Brent Hoberman, and sold it in 2005 for a whopping £577 million when she was only 31.

We revisit this fascinating story and discuss how they raised money for their innovative idea, how they became one of the most popular online travel platforms during the dotcom boom of the early 2000s, what happened after they went public, and how Marta’s life was changed by a serious accident.

***

You can listen (16 min) and subscribe here:

***

Who is Martha Lane Fox?

Martha Lane Fox is a British businesswoman, philanthropist, and public servant. She is best known for co-founding Lastminute.com during the dot-com boom of the early 2000s. She is the president of the British Chambers of Commerce, the UK’s network and voice for UK and global businesses, Chancellor of the Open University, and a member of the House of Lords. She also sits on the board of WeTransfer and Channel, is a trustee of the charity the Queen’s Commonwealth Trust, and has a CBE.

In 1994, Martha graduated from university and fell into a strategy consulting company. It was focused on the media and telecom sector which meant she was learning about the internet as it was just emerging in the consciousness of the business landscape. Here she first met with her future business associate Brent Aberman. He was always arranging everything at the last minute. He was always late and he had a lot of friends and had a lot of planning to do so every Friday night she’d see him in the office calling loads of hotels, booking loads of restaurants, looking at the papers to find out what was going on. But with the emergence of the internet, Brent comes to Martha and says “I think there’s a better way to do this”.

This is how they began to envision an online travel and leisure store that would offer last-minute holiday deals to consumers, including flights, hotels, package holidays, entertainment tickets, gifts, and restaurants. They believed that suppliers should be involved in lastminute.com to make it a success.

However, their idea was not well-received initially. Investors were skeptical about the idea of people buying things online and did not believe that the internet could be used to purchase products. Despite facing numerous rejections, Martha and Brent persevered and continued to pitch their idea to investors. After six months of trying, they finally secured £600,000 to build the first version of the website.

The original website was held together with ropes and string and was not a smooth process. Martha and Brent were making up a lot of ideas as they went along, trying to figure out how customers could make purchases on their website and creating a blueprint for how we do things online today.

Their hard work paid off when they started offering incredible products like £99 flights to New York, which quickly gained popularity and spread like wildfire. They began to see real momentum and started getting attention in the media. Their company was unusual, with two young entrepreneurs, one of whom was a woman, and a sexy product. Martha became the face of the tech boom.

The Dot-com Bubble

“The tech bubble burst, and a speculative frenzy in tech and internet-related stocks gave way to a stock-related check. Investors, who had driven the valuations of countless tech companies to unsustainable levels, suddenly realized that many of these firms lacked a viable business model, let alone profits.”

The dot-com bubble was a period of extreme growth in the technology sector during the late 1990s and early 2000s. The mere addition of “.com” to a company’s name was enough to inflate its value and attract eager investors. This era was marked by remarkable innovation, turning the digital landscapes into a realm of boundless opportunities with an abundance of capital.

During this time, a wave of internet startups emerged with the goal of changing the world. Amazon and eBay launched in 1995, Google in 1996, and Copants.com in 1998. Lastminute.com, founded by Martha Lane Fox and Brent Hoberman in 1998, was one of the many internet startups that emerged during this period.

Lastminute.com was a pioneering online travel agent that offered last-minute holiday deals online. The business swiftly became the darling of the dot-com era, but it had a much more long-lasting legacy. In March 2000, Martha floated lastminute.com on the stock market, which was a tough and last-minute decision.

The company was growing, but it had a disproportionate kind of brand recognition to the actual size of business that it was. That was partly due to people embracing the internet. Gone was the stigma behind investing in an internet company. Everyone wanted a piece. It was officially the dot-com boom.

In March 2000, the company went public by offering shares to the general public, raising capital to expand its business. The IPO provided liquidity to early investors and employees who could sell their shares, while also enhancing the company’s visibility and credibility in the financial market, potentially paving the way for further growth and acquisitions.

Martha Lane Fox recalls that the valuation of the company was insane, with no way to justify that a company of their size was valued at nearly a billion dollars. However, the shares, placed originally at 380p, leaped to 511p in the first hour of trading, boosting the value of the company from a starting point of 571 million pounds to 768 million pounds .

How it All Went Wrong

However, a week after the IPO, the US tech bubble collapsed. The battering that the company took was described as nothing short of breathtaking, with a points drop never before seen on the US markets. The tech bubble burst, and a speculative frenzy in tech and internet-related stocks gave way to a stock-related check. Investors, who had driven the valuations of countless tech companies to unsustainable levels, suddenly realized that many of these firms lacked a viable business model, let alone profits.

As confidence waned, panic selling ensued, resulting in a dramatic market correction. Many dot-com startups went out of business after burning through their venture capital and failing to become profitable. The fragile technology stocks were even harder hit, with the Nasdaq index in freefall down nearly 10%.

Martha Lane Fox recalls that she was really vilified in the press. Lastminute.com went from being the heroes of the hour to the villains, and that had a big toll on people internally in the company. The share price went from £5.35 to 19p, and people internally were now a bit ashamed of working at lastminute.com. It was a very, very dramatic fall, and all they could do was just keep focused on the actual business, encourage people not to think too much about what was the outside commentary, but just focus on what they could control internally in the business.

Despite the challenges, lastminute.com kept going, trying to search deals and products for a website and improving the technology as well as making acquisitions. They bought a big company in France and several companies around Europe. In an interview from the Gentle Women, Martha says that without doubt, one of the worst days at lastminute.com was when she had to make the whole customer service team redundant because they were going to outsource their role to India. In retrospect, that was probably a mistake.

Accident and recovery

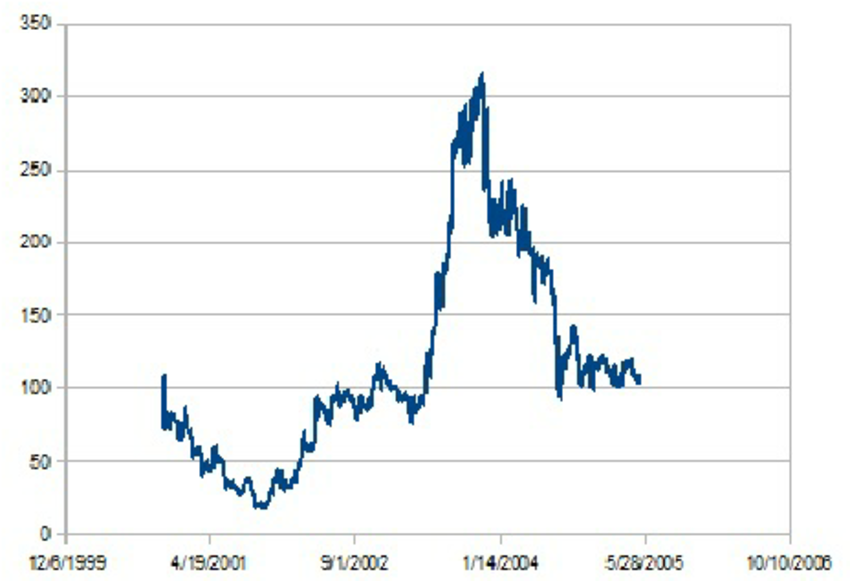

Lastminute.com Stock Prices during the alleged Dotcom Bubble.

Martha’s was looking for a change in her career and wanted to experience something different. After talking to the board and making a public announcement, Martha was ready to start a new life. She had all these plans about her future and what she was going to do next. However, her life took an unexpected turn when she had a catastrophic car accident and was hospitalized for two years. Her whole life changed and has changed forever.

During her hospitalization, Martha realized that it was the right time to sell her business. She had an offer and was only on the periphery of that negotiation, obviously part of the decision because she was still a shareholder and part of the company, but she was also very broken and high on morphine. So she wasn’t making much sense in a deal acquisition moment. Just like that, it was all over.

Lastminute.com was sold for £577 million in 2005. Martha holds around 7% of the shares. She earned about £13 million from the sale. She believes that she would be dead if she hadn’t been able to make some money because she was able to afford to fly herself or get somebody to fly her in a special plane from where she had the accident to pay for extra nursing, to pay for extra care, all of the things that made it go from life to death to life situation.

Martha’s story highlights the importance of sound fundamentals and caution in investing as excessive speculation led to a market correction. While we need innovation and want to invest in growing companies, it’s also important to be mindful of the risks involved.

Lessons Learned

Investing can be a daunting task, especially if you’re new to the game. However, there are some basic principles that you can follow to make the most of your investments. If you need the money in the next few years, it’s wise to take on less risk. However, if you have a longer time horizon until you require the funds, maybe for retirement in 20-30 years, you might consider a high-risk, high-return investment profile.

It’s important to keep your emotions in check when investing. Emotions can lead to impulse investment choices that you can later regret. So try to stick to your strategy and keep your feelings in check. This is really hard, but you will learn this by actually doing and by investing, by having some skin in the game.

Finally, keep learning. The investment world evolves, so keep educating yourself, especially about investment principles. You don’t need to check your investments every day, but once you have a plan, then you feel more confident about your own investment strategy.

If you’re not sure about where to invest, you can always talk to a financial advisor. They can help you understand the risks and rewards of different investment options and help you make informed decisions. Remember, the dot-com bubble was a big event, but it’s just part of the whole investment story. Learning from past mistakes can help you make smarter investment choices for your future.

****

RESOURCES:

SPONSOR:

Thank you to our partner PensionBee: combine, contribute and withdraw online. Take control of your pension, so that you can enjoy a happy retirement and join 223,000 customers saving with PensionBee. When investing, your capital is at risk. Investments can go down as well as up, and you may get back less than you invest.

OTHER EPISODES OF BANKING BAD:

#1 Brooke Astor, and When Financial Abuse Hits Home

#2 Tulip Mania, The Greatest Bubble Story of All Time

#3 How I Ended Up £250,000 in Debt

#4 Surviving the Dotcom Bubble with Martha Lane Fox of Lastminute.com

#5 GameStop, How Reddit Users Brought Wall Street to its Knees