What On Earth Are We Doing With Our Money?

You may already know Refinery29’s Money Diaries… this is our own version of it! We’ve put together a few questions to understand what women are doing with their money. Let’s break the taboo and talk more about finances!

It’s short, snappy, fun and anonymous.

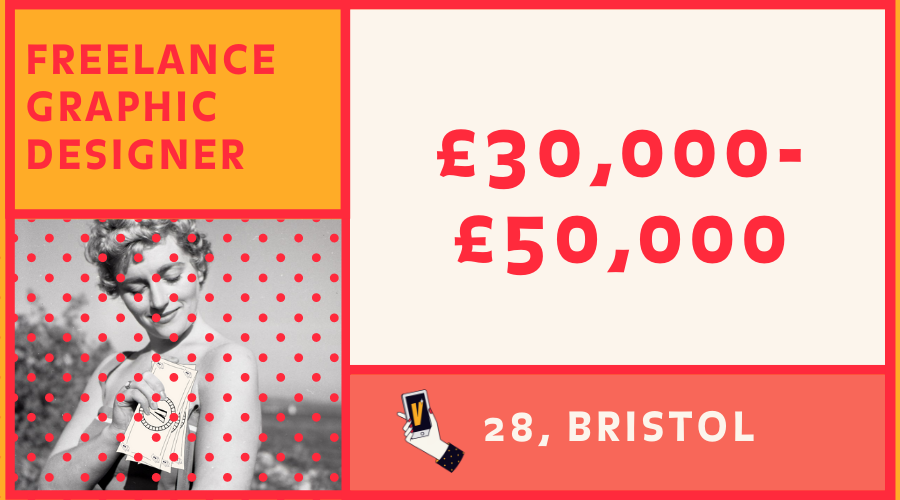

Freelance graphic designer who works from home. Bristol. 28. Living with my boyfriend, no babies, furry or otherwise.

Financial goals:

Short term (1-5 years): Be 100% debt free, up my pension contributions, grow my side-hustles to become my main income.

Medium term (5-10 years): Keep building my side-hustles, keep investing in index funds, move to London.

Long term (10 years +): Buy property, help my mum buy a house, build my pension to a million bucks (which would only cost me £6/day if I start today. Yay compound interest!) and be financially free enough to visit my family in Australia frequently.

Best buy ever: I kneel at the altar of Apple so gotta say my Mac (£750 off Gumtree) and Macbook Air (I avoided the VAT by buying it in Hong Kong). They're how I've made my living since 2014, so literally couldn't live without them.

Worst buy ever: Most fast fashion impulse buys (£5-50). They're always the pieces I end up donating. So wasteful.

Things you spend the most money on: Rent and food.

Salary / Income: Being a freelancer in a pretty volatile industry, it varies. £30,000-£50,000

Net worth (what you own vs what you owe, or your assets minus your debts): £1,500

Any side hustles: Kindle Direct Publishing £350/mth, Amazon Merch £20/mth, Etsy £10/mth (She's still a baby)

Savings: Got my new Monzo pot up to a whopping £130. Otherwise, no - money stays in my company or is being used to pay down my debts.

Home: Nope. I'm a renter.

Debt: £4,500 on an interest-free credit card that I'm paying down before the interest kicks in. £1,500 with Paypal Working Capital from my old sole trader business, also interest-free.

Investing: A Stocks + Shares ISA with Freetrade app - £350 but this is on pause until my debts are gone.

Pension: Yes, stuck in Australia until I'm of retirement age (I'm a Kiwi so no early withdrawals for me) - £6,200 approx. My PensionBee in the UK is only at £200 so far.

Insurances: Home and contents insurance with Nationwide. Travel insurance for any trips I take.

What is money for you? Freedom, peace and security.

What is financial independence for you? Not letting money stress me out ever again, unless it's because I have too much of it. My mum, being a single mother, struggled financially and it took a toll on her. I don't want to ever experience that hardship.

THANK YOU!

🙋🙋 Please help us break the taboo and participate here 🙋🙋