How to Build a Money System That Actually Works

A simple 90-day framework for clarity, control, and confidence

Feeling organised with money but still unsure or overwhelmed? This guide shares a simple 90-day framework to build a money system that brings clarity, control, and confidence, without jargon or overwhelm.

Most people aren’t bad with money.

They’re trying to do their best.

You probably have the accounts, the savings pots, maybe a personal pension. You’ve read the articles, downloaded budgeting apps, and jotted down financial plans. And yet, somehow, money still feels elusive. Complicated. Frustrating.

This isn’t because you’re doing something wrong. It’s because you don’t have a system that works for you.

We hear this frustration all the time. And no, it’s not from people who are careless with money or haven’t got a clue. We hear it from those who are “doing the right things”, yet still feel like they’re behind.

Here, we outline the key ideas shared in our recent Vestpod Live session, introducing a simple 90-day framework designed to help money feel clearer and calmer. It’s not perfect - but it should make your financial life a lot less stressful.

Why money feels so hard

Money stress rarely comes from a lack of effort. It usually comes from ambiguity.

You’re saving, but not sure if you’re directing your money in the right way

You track spending, but still feel like you’re behind

You want to invest, but don’t know where to start

You avoid looking at the numbers, because you feel shame and overwhelm.

Then there are real-life constraints: rising costs of living, single incomes, caring responsibilities, or volatile income. All of these things compound and have a profound effect on our finances.

A good money system doesn’t pretend that these issues don’t exist.

A good money system helps you make clearer decisions despite them.

The four pillars of a money system that works

We recommend the use four simple pillars. These aren’t about ‘quick fixes’ or ‘money hacks’. They’re about structure.

1) Awareness

Understanding your money and your habits calmly, without judgement. This is where everything starts. Not with fixing or changing, but with seeing. Numbers, patterns, behaviours, avoidance. Calm awareness comes before action. If looking at your money feels stressful, every decision feels heavier than it needs to be.

2) Everyday money

This is how money shows up in day-to-day life. It’s everything from spending, cash flow, and the small decisions you make all the time. When everyday money feels chaotic, long-term plans become very hard to stick to.

3) Priorities

What your money is designed to do - either now and later. This is where money connects to life. Short-term needs. Longer-term goals. Trade-offs. When priorities are clear, decisions stop feeling like guesses. Money without purpose creates anxiety.

4) Consistency

Actively building wealth through simple systems that support the life you want. This is where money stops being a project and starts fitting into real life. Habits, routines, and reviews matter more than intensity. Consistency is what turns clarity into progress.

Why a 90-day framework works

You don’t need to fix your entire financial life at once. Money moves in cycles. Monthly pay, bills, saving, reviewing. Ninety days is long enough for things to start feeling different, but short enough to feel manageable.

Month 1: Understand

You need to have clarity before change

In the first phase, very little needs fixing.

Gather the accounts. See everything in one place. Notice where money feels messy or stressful. Stop guessing.

The goal here is not a perfect bank balance - it’s clarity.

Month 2: Organise

Make fewer decisions, enjoy more ease

Once things feel clearer, organisation becomes possible.

Saving becomes automatic. Spending reflects priorities more closely. Fewer decisions are up for debate.

Money takes up less headspace.

Month 3: Grow

Progress you can sustain

Only then does growth make sense.

That might mean learning about investing, checking a pension, or starting with a small, repeatable amount. Nothing dramatic. You know you can review and adjust later.

The focus is not speed but consistency.

Different starting points, same system

Most people recognise themselves in one of these places:

Organised, but anxious.

Avoiding money because it feels heavy.

Saving consistently, but not growing.

Support helps systems stick

Money systems work better when they aren’t built in isolation.

That support might come from a partner, a community, an adviser, or a structured programme. Support is not a weakness. It is part of designing systems that hold up when life gets busy.

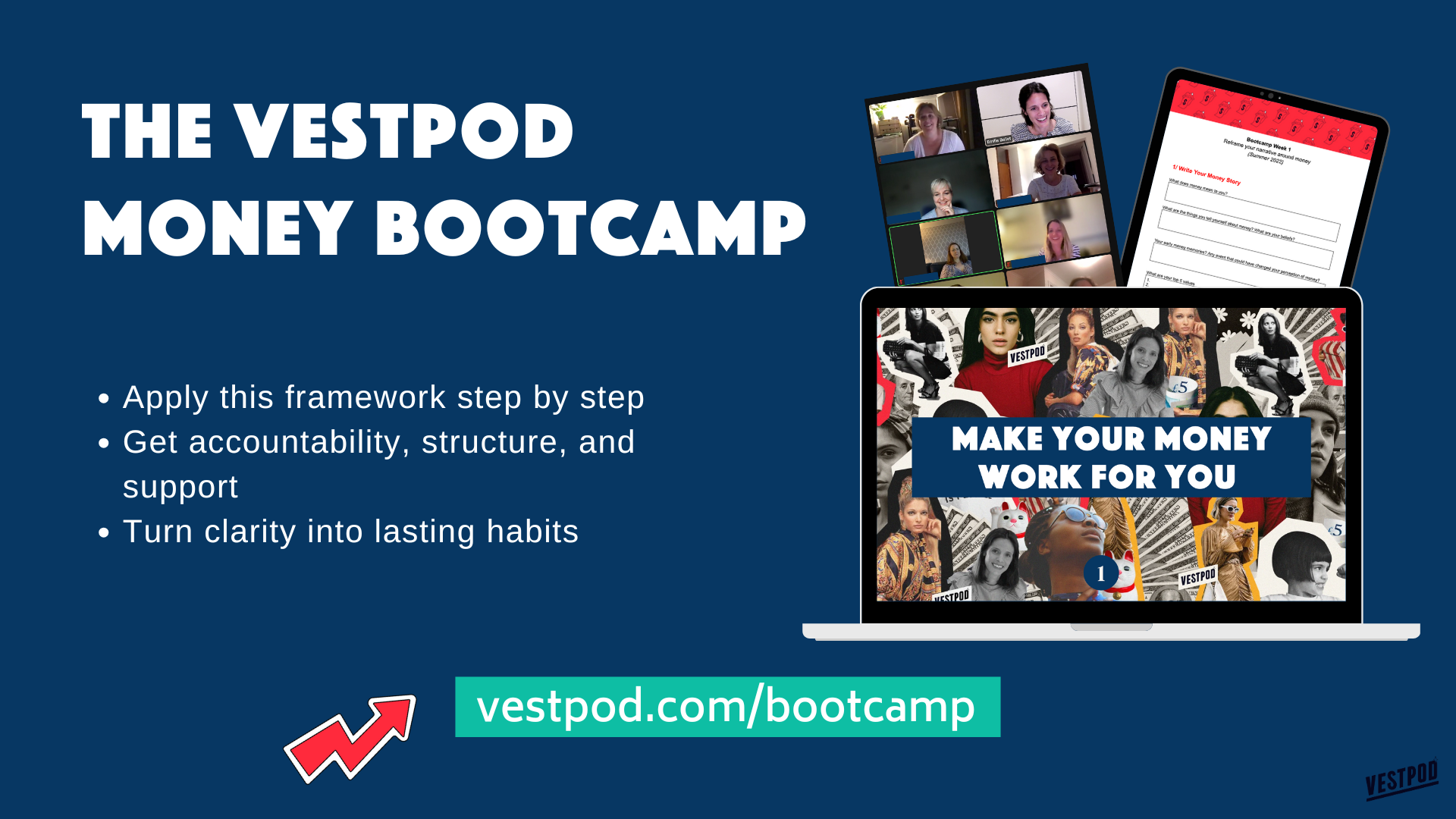

Turning clarity into action with Bootcamp

The live session was about all clarity and structure. If you would like support applying this framework step by step, the Vestpod Money Bootcamp builds directly on what we covered. It focuses on guided implementation, accountability, and building habits that last, without pressure or jargon.

Find out more here: