Your Essential Economic & Stock Market Update (2023 Outlook)

Everything You Need to Know About the Economy and the Stock Market Today

This event/webinar is purely educational and does not constitute as financial or investment advice. With investments, your capital is at risk. Investments can go down in value as well as up, so you could get back less than you invest.

📈Market updates are usually laden with jargon and reserved for the institutional or expert investors. But not this one! That’s why we have prepared a no-nonsense, easy to understand quarterly economic and market update with Axelle Pinon, portfolio adviser and member of the investment committee at Carmignac, and Emilie Bellet, Founder of Vestpod:

What happened in the markets in 2022?

What is the deal with inflation?

What will happen as China reopens?

What does the outlook for 2023 look like?

Deep dive: we'll look at 4 stocks in different sectors to learn more about pricing and valuation.

Carmignac is an independent asset management firm established in 1989 on three core principles that still stand true today: entrepreneurial spirit, human-driven insight and active commitment. The role of Carmignac is to enable their clients to improve their savings needs over the long-term.

*The webinar was recorded on January 26th, 2023*

(unfortunately due to technical issues we were unable to record the live videos of Axelle and Emilie during screen sharing - we hope this doesn’t cause any inconvenience!)

Key takeaways

We’re past the worst - but inflation will remain high for several years.

Keep an eye out for the luxury sector, healthcare, oil and Europe as China reopens, plus lower energy prices and attractive valuations.

China’s reopening will have a big impact on the global economy.

Trends fade over time. As investors, we need to be diversified according to the phases of the economic cycle and not only bet on one big trend.

We need to be focused on the long-term but we also need to be active. If you’re not an active investor, it helps to work with an active manager that will help you manage the cycle in this very complex environment that we’re seeing in financial markets.

Summary of the session

A quick overview of where we are today

As you might know, the stock market has been declining since January, 2022. We've seen a lot of inflation with the Fed trying to tackle inflation by raising interest rates and we also saw a decline in investor confidence.

So what happened in 2022? It had been a tough year for investors, consumers, governments and central banks. All the struggles came down predominantly to one thing: surging inflation. We hit a 40-year high in the US, UK and Europe, which led to a complete collapse of equity and bond markets. Global equities were down by 16% last year, and it was similar for fixed income indices. Some countries did better than others, however.

For example, Latin America, a huge exporter of commodities (the only asset class that wasn’t harmed in 2022), did well. Europe and the UK also outperformed the US due to weak currencies that boosted exporting companies.

Another country that didn’t do well in 2022 is China, which was hurt by a long-lasting zero Covid policy that penalised growth. The tech sector, too, was badly hit and the crypto markets have exacerbated all the negative factors that have been affecting the markets.

What’s behind it all: inflation in 2022

Inflation continues to be a primary concern. Inflation is a measure of the rate of rising prices of goods and services in an economy - which means a loss of purchasing power over a time. After years of low inflation, last year the US saw 9% inflation - a 40-year high.

The pandemic caused factories to shut down, blocked shipping routes and pushed prices up. With the reopening of the economy in 2021, we saw a fast rebound in demand, which fuelled inflation (this is known as demand-pull inflation).

We also saw a detrimental effect on wages due to labour shortages in the service industries.

The last factor that explains this inflationary shock is commodities. It started with oil and with the reopening effect post-Covid, and then it accelerated with the war in Ukraine which increased pressure on gas and also on food.

When inflation is already high, it feeds itself. When workers receive a wage hike, they demand more goods and services and this in turn causes prices to rise. It is very tough to get out of this particular type of inflation loop. This is why in 2022, Central Banks across the globe stepped in very quickly to try to stop inflation. They did this by raising interest rates which created a rates shock that had a direct impact on both equity and fixed-income.

Inflation predictions for 2023

The good news is that the peak of inflation is behind us, and we are now entering a period of decelerating inflation. The deceleration of inflation is led by the most cyclical component of inflation, namely the energy prices that are going down, and the fact that we have less of a bottleneck after the strong supply demand imbalance post-Covid. In Europe, it's also helped by the fiscal measures that have been taken by governments in order to cap energy prices.

While there is some relief, one component of inflation that remains highly resilient is wages. Wages are growing at a very fast pace both in the US and the UK - in the UK, the private sector wage growth is more than 7%. Then, there is the acceleration of the energy transition, leading to massive investments in renewable and alternative energies - which is costly over the short and medium term, feeding inflation.

It is also important to note the role of globalisation. Until a few years ago, globalisation and the competition that we had between counties resulted in disinflationary pressure, with prices going down. Today, governments and consumers are pushing towards a policy of nearshoring - the practice of transferring a business operation to a nearby country, especially in preference to a more distant one.

Finally, we need to look at the demographic effects in relation to inflation. Across developed economies, the population is getting older which creates a shock to the job market due to less people being available to work. We are thus seeing higher wages, as industries look to attract more people. This puts pressure on wages in a structural manner.

Can inflation ever be a good thing? High inflation can be harmful, but too little can weaken the economy. The ideal is somewhere between 2-3%.

Global growth outlook

Lower inflation usually comes alongside slower growth. But economists are forecasting a rise in growth in both Europe and the US in 2023. While we were expecting a recession in the first semester to hit the US, this likely won’t happen till the end of 2023. This is because the average US consumer is still doing well due to significant wage growth, as well as post-pandemic savings.

China will begin to bounce back thanks to the end of their zero-Covid policy, which will boost its growth. Europe, too, has the worst behind it - or at least, they are in the middle of the worst it can be in terms of growth. Additionally, China’s re-opening spells good news for Europe.

Europe has also benefited from a better gas and energy situation since we’ve had mild temperatures and a very high level of gas storage. This has limited the risk of rationing which was a big fear among European governments.

Overall, we are facing a desynchronisation of the economic cycle across the world. China is recovering while Europe is climbing out of a mild recession, while the US should enter one at the end of the year. The desynchronisation of the economic cycle can offer a lot of attractive opportunities for investors.

What about the stock market?

After a very tough 2022, we are finally seeing some good news, which pushes the stock market higher.

Recovery is on the way. The S&P500 (the Standard and Poor's 500 is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the US) saw a rebound of 12% since the lows of October. Looking at European indices, they’re up almost 20%.

As the growth forecast is raised across major regions, decreasing inflation is boosting consumer confidence. This means that by the middle of this year, Central Banks might consider pausing the interest rate hiking cycle.

However, we have to keep in mind that inflation will still remain high for some time. Inflation will remain sticky while we continue to face huge pressures from the labour market. Currently, we are in the middle of the earning season - which means that companies are publishing their earnings for last year and giving their forecasts for this year. Companies are seeing more margin pressures, because until now they have been able to raise prices and people were still consuming. But with inflation beginning to decrease, companies will be less able to keep raising prices - therefore the margin will get squeezed in the middle. We can therefore expect to see a downward revision on earnings, which means that investors will expect less earnings growth from companies compared to what they were previously used to.

This will keep the pressure up on equity markets for this year — giving you time to adjust your predictions.

As for the tech market — we’ve again been seeing huge layoffs. Tech stocks were down more than 60% last year. Tech companies relied on huge investment programs in order to fill long-term growth at the cost of short-term profitability. Now that we are reaching the end of a tight monetary policy, investors are looking for profits that can be delivered in the near-term. This is why most tech companies have announced layoffs and budget cuts, with the cost saving preserves expected to continue in the coming months.

Macroeconomics and investments

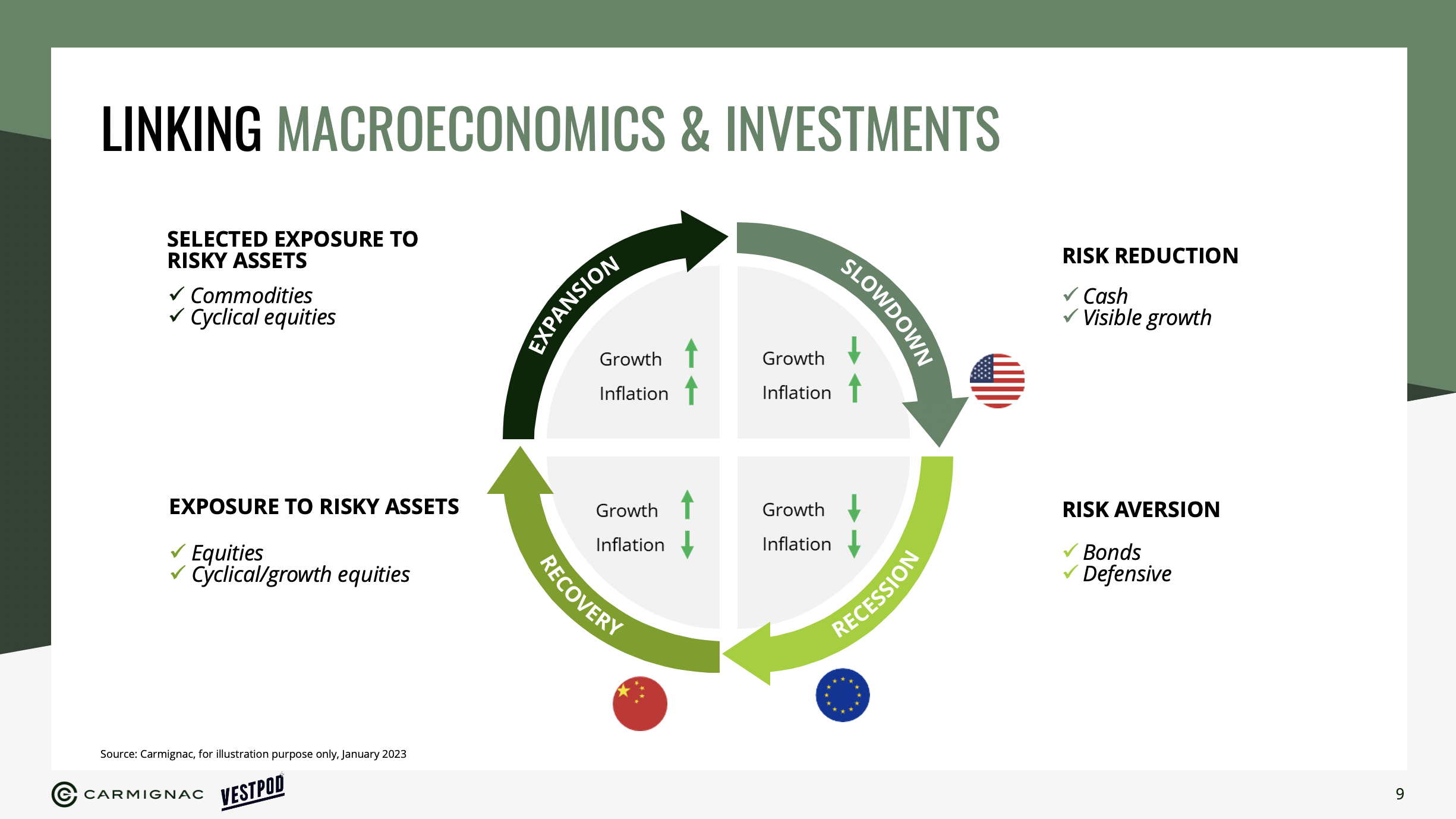

This diagram is a simple framework that helps you understand economic cycles and their links with investments. The classic cycle will start from the bottom left and move clockwise. The actual market is, of course, usually more complicated than theory, but this framework is still incredibly helpful.

First, we have Phase One. This sees the recovery when growth pics up and we have low levels of inflation, therefore it's the best time for stocks. In this recovery phase we look for companies that can benefit from better growth prospects in the world that could exhibit high valuation. How much an investor might estimate the value of the firm does not matter in this phase of the cycle, because investors are already paying a very expensive price for a company that will offer them long-term growth.

In the Phase Two, growth accelerates sharply, approaching its peak, and with it, inflation goes up. This is a bad time to invest in bonds because bonds hate inflation. With equities, you’ll be focused more on companies that are late in the cycle.

Phase Three is the slowdown, where growth decelerates and inflation continues to rise. As an investor, you would start decreasing your overall level of risk and buy companies that do well independently of the cycle (as currently the case in the US).

Finally, in Phase Four, we have the recession. This means negative growth and inflation going down. This would be the best timing to buy bonds, whereas you would be very careful with equities.

The fact that currently, economic cycles are synchronized is great for investors because we can cherry-pick the right asset class, the right sector across regions and thus extend our number of opportunities. This is also why it is very important for an investor to be global and not only focus on one region.

However, investing in the financial market it's a bit more complex than simply choosing between equity bonds, cash and commodities.

As an investor, you should do the following:

Choose the companies that exhibit the best capabilities, the best products, the best business models compared to their competitors. This is what we call the stock selection.

Then, you need to adapt the stocks that we own in our portfolio according to where we are in the cycle. That’s what we call market allocation.

Investment themes in the current cycle

Europe: Recession is ending and Europe is heading toward the recovery phase. It is also benefiting from China’s reopening markets.

Luxury: Luxury brands are largely insulated during economic slowdowns because most of their sales come from the ultra-wealthy who are usually not severely affected by recessions. With China reopening, luxury brands are likely to enjoy more growth.

Healthcare: This sector is not sensitive to inflation. Instead, it relies on structural trends like an ageing population and an increase in chronic diseases.

Oil: There have been no investments in the oil sector over the last 10 years, which means that today we have a huge imbalance between demand and supply. China’s reopening will also mean it will need extra oil to help recover its economy.

China’s reopening and the global economy

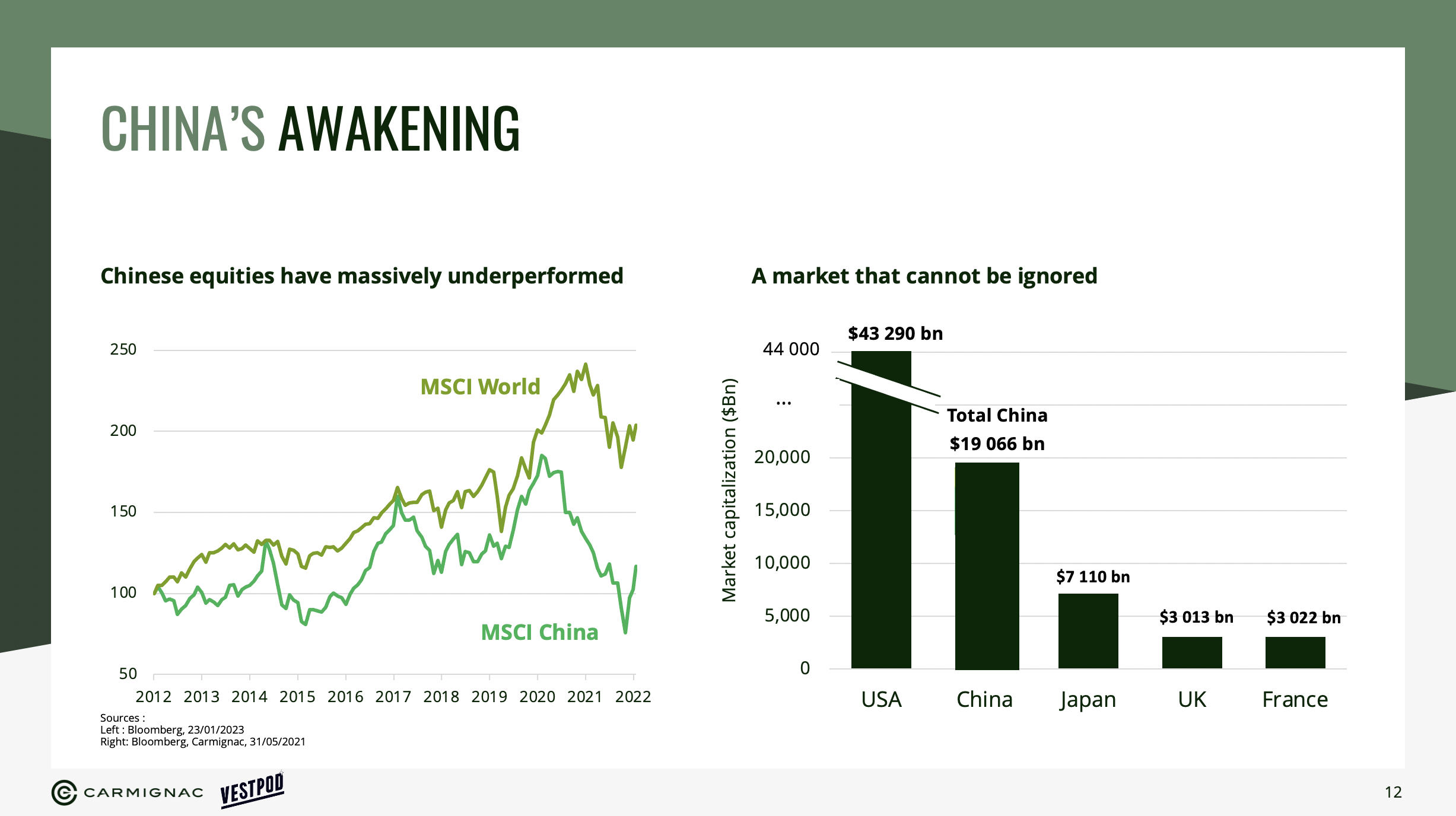

Last year, China's stocks reached their lowest level since 2005. Several risk factors had a severe impact on China in the past 18 months, and these factors are currently reversing. Things we’ll be seeing in China this year:

Easing of regulations

End to zero-Covid policy

Geopolitical tensions over Taiwan will remain

China is a leading emerging market player with a global powerhouse, and it's a must have for an equity investor. It is the second biggest market in the world in terms of market capitalization, second only to the US, and it contributes to about 70% of the global GDP.

Finally, are we looking at a new paradigm? Each decade has been dominated by one theme, as shown by the the great secular de-ratings since 1990:

Q&A

Can you please explain why you are looking at oil stocks [at Carmignac] if you have a sustainability strategy?

2%. That’s how much of the world’s energy system is currently powered by renewables, versus 82% for fossil fuels. Therefore, replacing completely fossil fuels for renewables is, at the very least, oversimplistic. Energy policies introduced since the signature of the Paris Agreement in 2016 have so far fallen short of the goal of achieving carbon neutrality by 2050, which would require renewables to account for at least 25% of the world’s energy system. There is still time to change course, but only on one condition: that we act now. And oil and gas companies have a lot to bring to the table to support the energy transition. Said differently, they are a major part of the problem, but they will also have to be part of the solution to reach the net zero target.

We are already seeing some European oil majors making commitments to this transformation. It may not be seen as moving fast enough by those who want these companies to completely divest away from their oil and gas business. However, their efforts along the whole supply chain of fossil fuel extraction to the clean alternatives at the pump can make a difference and must be acknowledged, monitored, and encouraged through active stewardship.

While Carmignac has integrated environmental, social and governance (ESG) criteria since its inception, the emphasis is now on our engagement through dialogue with companies in order to lead them towards more sustainable solutions, our objective being to ultimately have a positive contribution to the environment and society. To this end, we have developed a specific engagement policy with key players in the transition process, involving enhanced and more regular exchanges. Indeed, today, the finance sector has a major role to play in the ecological and energy transition not only by engaging with oil and gas companies but also by responding to the problem of insufficient funding to deal with climate change

When would be the ideal time to invest in the stock market considering the current macro environment and the UK economy?

Investing in the stock market is really about time not timing. When you have a massive market correction like the one we experienced in 2022, the main risk is to sell at the worst moment. Over the last 20 years, if you have invested $10,000 in the MSCI World, you will have earned around $46,000. However, if an investor has tried to time the market and unfortunately missed only the 10 best days, its gains after 20 years will only be $27,000. These 10 best days are hard to capture as they tend to be very closed to big sell off.

Therefore, in highly volatile market conditions like the one we are currently experiencing, everything is about your investment horizon and not about the market timing.

Thank you for joining us!

Resources

Follow Axelle on LinkedIn

The Wallet podcast: Breaking Down Investing Barriers and Championing Women, with Maxime Carmignac

Principles for Dealing with the Changing World Order by Ray Dalio (Youtube)

Carmignac is an independent asset management firm established in 1989 on three core principles that still stand true today: entrepreneurial spirit, human-driven insight and active commitment. We are as entrepreneurial today as we have always been; our team of fund managers keeping the freedom and courage to perform independent risk analysis, translate it into strong convictions and implement them. Our collaborative culture of debate, on-the-ground work and in-house research means we will always enhance data analysis with human-driven insight to better manage complexity and evaluate hidden risks.

We are both active managers and active partners, committed to our clients, providing transparency on our investment decisions and always be accountable for them. With a capital entirely held by the family and staff, Carmignac is now one of Europe’s leading asset managers, operating from 7 different offices. Today, as throughout our history, we are committed to try harder and better to actively manage our clients’ savings over the long-term.