New Tax Year New Rules

Phew. We’ve just started the new financial year (=2018/2019), and boy are we glad to have all that tax faff out of the way. But don’t relax just yet - the government’s making some important changes in the new tax year, and it’s crucial you keep in the loop. Here’s the some of the latest:

Income Tax

£11,850 Personal Allowance: Your personal allowance - the amount of income you don’t have to pay any tax on - increases to £11,850 for 2018/19 (from £11,500 in 2017/18).

£34,500 Basic Rate Limit: Tax thresholds are changing, too. This is the tax paid on the amount of taxable income remaining after allowances have been deducted. The basic rate limit increases to £34,500 for 2018/19 (from £33,500).

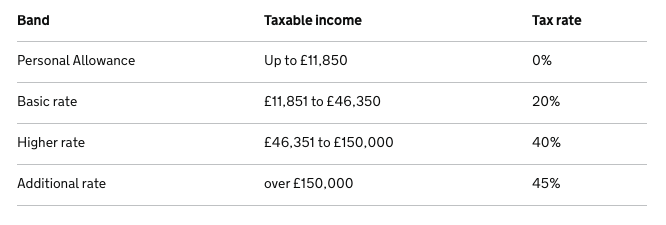

Income Tax Bands: Here are the up-to-date income tax bands:

ISA (Individual Saving Accounts)

£20,000 ISA Limit: The limit on ISA’s is maintained at £20,000 a year for UK residents over 18. You can split between a Cash ISA, a Stocks & Shares ISA and an Innovative Finance ISA. If you are between 18 and 40, you can also look into the LISA (the lifetime ISA). The LISA allows you to save up to £4,000 a year - in either cash savings or stocks and shares - and the government will contribute an extra 25% (up to £1,000 a year). The money saved can be either used for a new home or retirement.

£4,260 Junior ISA: Saving for your little ones? The junior ISA and child trust fund limits are increasing from £4,128 to £4,260 a year. Grandparents and relatives can also contribute into this account.

Remember that the investments you hold into an ISA are protected from capital gains tax and income tax but also that annual ISA allowances cannot be carried forward: you haven’t used it for the year, well it will be lost forever.

Pension Contributions

The annual allowance on pensions contributions is a limit on how much you can contribute each year - while still receiving tax relief. It is unchanged and capped at £40,000 - and up to the lower of 100% of earnings or the maximum contribution (i.e. the annual allowance plus unutilised allowances from the three previous tax years.) Even if you don’t earn you can contribute up to £3,600 a year. The lifetime allowance is up to £1,030,000 from £1,000,000 last year.

Capital Gain Tax Allowance

The capital gains tax ‘annual exempt amount’ (the maximum profit you can make on selling assets without paying capital gains tax) will rise to £11,700.

Dividend Tax Allowance

You can earn up to £2,000 in dividends before you pay any tax in the 2018/19 tax year (reduced by more than half, from £5,000 in the 2017/18 tax year.)

Personal Savings Allowance

From 6 April 2016, if you're a basic rate taxpayer you'll be able to earn up to £1,000 in savings income tax-free. Higher rate taxpayers will be able to earn up to £500.

Do check with your financial adviser, this is not an exhaustive list and could change. Allowances and tax rates also depend on your personal circumstances! For the full details visit the Gov.uk website.