Your Essential Economic & Stock Market Update (Q2 2022)

Everything You Need to Know About the Economy and the Stock Market Today

This event/webinar is purely educational and does not constitute as financial or investment advice. With investments, your capital is at risk. Investments can go down in value as well as up, so you could get back less than you invest.

📈Market updates can feel overwhelming and complex - but we love them here at Vestpod! That’s why we have prepared a no-nonsense, easy to understand quarterly economic and market update with Axelle Pinon, Equity Product Specialist Manager at Carmignac, and Emilie Bellet, Founder of Vestpod:

What’s happening with the stock market?

How does the economy impact your investments?

What has been driving the stock market over the past few months?

Macro insights on inflation, cost of living, spending and interest rates.

What we can expect going forward?

The aim of the session today is to provide an understanding of what is currently driving stock markets and consider the outlook.

I am really happy to introduce our brilliant partners for this session: Axelle, who is an Equity Product Specialist Manager at Carmignac. Carmignac is an independent asset management firm established in 1989 on three core principles that still stand true today: entrepreneurial spirit, human-driven insight and active commitment. The role of Carmignac is to enable their clients to improve their savings needs over the long-term.

The webinar was recorded on July 7th, 2022. You can already register for our next update (Q3 2022) on September 20th, 2022 here.

**Listen to the episode of The Wallet here via Podfollow.**

Key takeaways

Around the World, inflation is on the rise. With food and energy prices hitting record highs, it is more important than ever to keep on top of our personal finances. It is helpful to understand what is causing inflation: disruption to the supply of goods, a recovery in demand as economies reopen post lockdown, and tight employment markets. There are 2 open jobs for every unemployed American, driving wages up! The challenge is how rising inflation threatens to slow economic growth and the pressure this may place on companies’ earnings.

To control inflation, central banks, such as the Federal Reserve in the US and Bank of England in the UK, seeking to tame inflation and preserve employment and economic stability have been raising interest rates and shrinking their balance sheets.

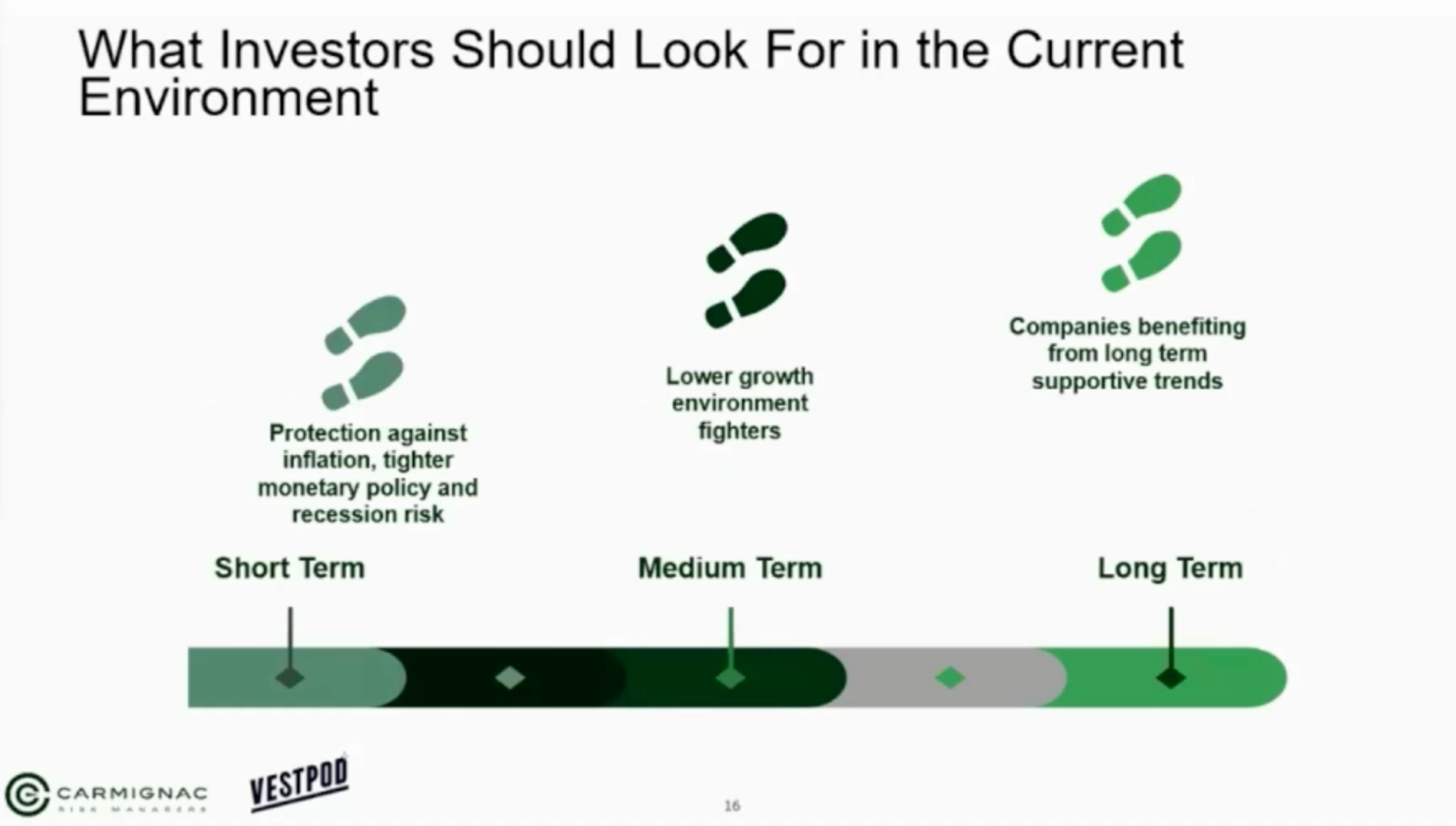

Going forward, investors (aka - you!) look for companies able to survive in current conditions and benefit from long term supportive trends, such as energy transition and digitalisation.

This uncertainty has created volatility in the markets, but focusing on the long-term is key. Keep learning, look at the big picture, and remember that investing is key to building long term wealth.

Summary of the session

A quick overview of where we are today

Things have been quite volatile this year – both politically and economically. While no one can predict the performance of the market, it’s always good to have an idea about sentiment and confidence. Our stock market update aims to outline the key stock market insights.Firstly, inflation is back. After 40 years of declining inflation, we are seeing prices rising across the board. Next, we have Russia’s invasion of Ukraine, which means investors have just experienced one of their worst six months in 40 years.

When we look at the four big asset classes in which investors are generally invested – equities, bonds, money market and cash equivalents, and real estate – we have seen that over the last four years, there is almost always at least one asset class that showed a positive performance. However, during the first semester of 2022, all asset classes have been negative.

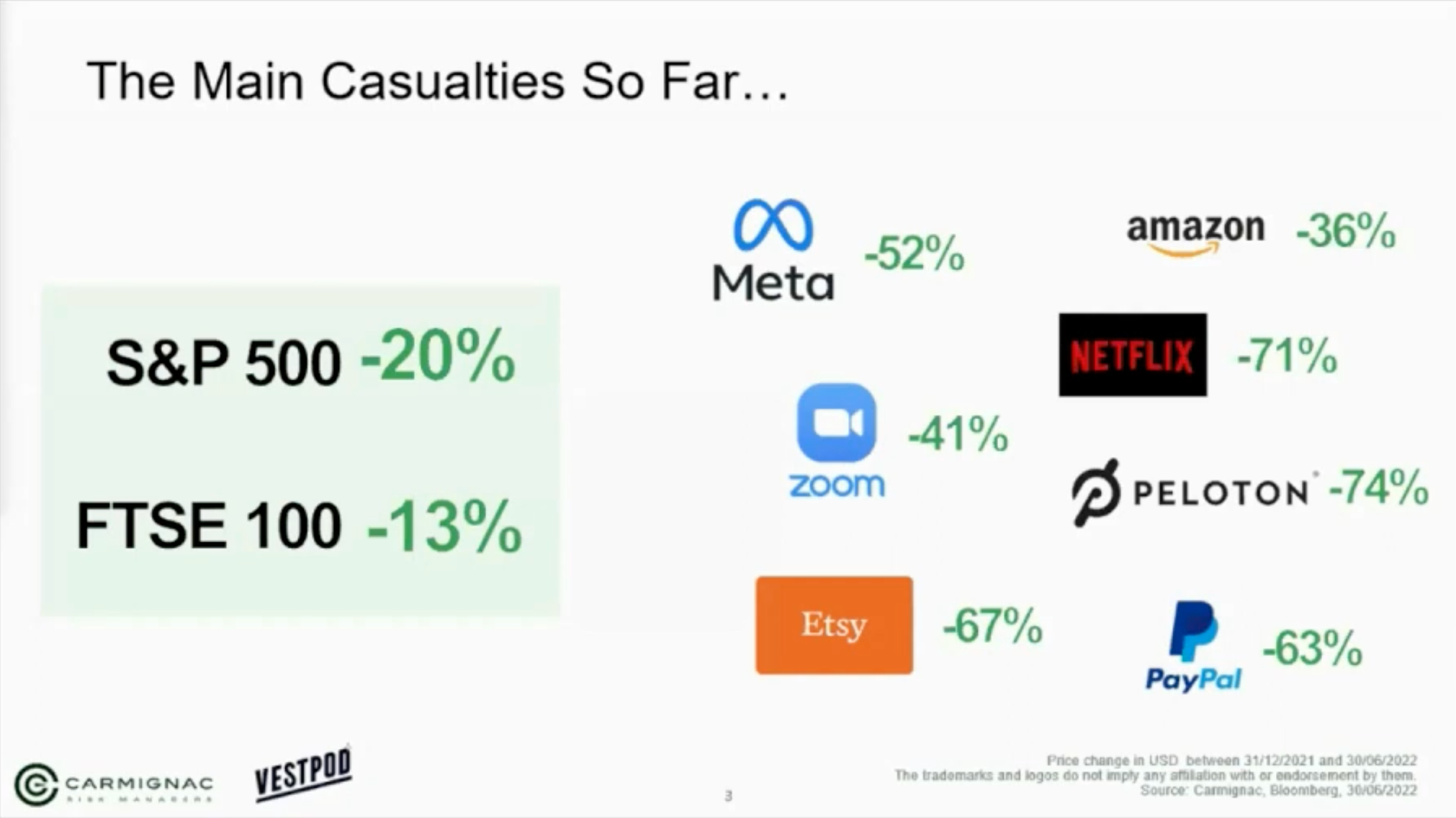

However, the performance of the tech sector has been huge over the last 10 years – mostly driven by the fact that tech companies were able to generate robust earnings despite the poor macroeconomic growth environment, and because of low-interest rates.

So what exactly happened this year? Firstly, the tailwind that pushed the tech stocks higher has completely switched direction – they are now becoming headwinds from low inflation. Higher interest rates have forced investors to rethink whether stocks that have succeeded in an environment of low-interest rates will be able to succeed in an environment of higher interest rates. Most tech companies prospered during the pandemic, and now that the population returns to work, and we spend less time at home, the tech sector suffers. Some people ask whether we are back in the dot com bubble like in 2000? No, we definitely don’t think that it's a dot com bubble 2.0 – it's just a massive overcorrection due to the fact that we are in a different rate environment.

The macroeconomic outlook

Today, the primary concern is inflation, because inflation is the loss of purchasing power over time. The pandemic caused factories to shut down, blocked shipping routes and pushed prices up. On top of this, we’ve also had issues with food and energy costs surging following the recent invasion of Ukraine. Today in the US, we see an 8.6% inflation – in part because of America has a stretched job market, with unemployment being at only at 3.8%. It is expected that we might see corporate America go into recession in the coming months – or, at the very least, a strong slowdown. However, the US central bank is trying to reverse the overheating that we are seeing in the labour market – to force demand to adjust downwards in order to fight inflation.

Markets are often focused on the actions of the Federal Reserve because it is the most powerful financial institution in the world, but we can see that other central banks, like European central banks and the Bank of England have similar mandates to the Federal Reserve. Unfortunately, in Europe, we have the same inflation issues like that of the US. We have new records of 8.6% over a year in the Eurozone, 9.1% in the UK, and we are likely to still have a very high level of inflation at least until the Autumn.

China and the global economy

China has suffered a lot from lower economic growth, mostly due to the fact that they have had very strict lockdown measures, especially this year. This has hurt economic growth and global supply chains across the world. Unlike the US, however, China put in place what they call a zero Covid policy, which was an attempt to prevent any community spread of the coronavirus. Because this lockdown hurt growth, the Chinese government decided to rescue its economic growth by doing exactly the opposite of what Western countries have done – monetary and fiscal stimulus.

For example, they have cut taxes for businesses and households, and have also been cutting their main benchmark interest rate. So exactly the opposite of the Fed. This is to support credit across housing and companies. Most of the economic actors in China depend on credit for investment, and when we have strong investment, it drives up employment and demand for import and industrial goods and commodities.

Stagflation and the credit impulse

Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation. Stagflation erodes the purchasing power of households and creates a profit margin squeeze. This is why it’s very important for Western central banks to avoid falling into a stagflation trap – because you have inflation, but you also have growth that is going down. This means you have higher unemployment and fewer earnings for companies. The challenge for the central banks today is to negotiate a soft lending of the economy in the face of this huge risk.

The credit impulse represents the flow of new credit issued from the private sector as a percentage of GDP. This is something that is often mentioned in the context of China – because all the market operators are looking at Chinese credit impulse because it's the barometer of whether it is in a good place right now in terms of growth. The Chinese economy is relying on credit for both households and companies.

What to do about investments?

While financial markets might seem scary at the moment, we should never lose sight of the fact that crises often turn into opportunities. Equities remain the best source of performance over the long term. Over the last 20 years, investing in global equities has been the best way to generate returns.

This is why it’s important to diversify your savings across asset classes, companies and sectors. It is also essential to keep a long-term investment horizon. The biggest risk to your investments is if you were to sell at the worst moment. You need to be active, you need to be patient, and perhaps you also need to be supported by asset management experts because today’s economic environment is highly complicated.

Outstanding questions asked during the webinar:

What are your thoughts about the housing market?

This is a difficult one! Many factors drive house prices, including inflation, supply and demand for homes and the economic outlook. In the UK, demand for homes continues to outstrip supply, and house price growth remains strong supported by record levels of employment, buoying confidence.

However, with inflation across many essential goods and services like food and energy squeezing households’ incomes (and confidence), and rising interest rates increasing the cost and availability of mortgages, many property market experts expect house price growth to slow.

For most of us, a house is not an investment but a home and likely to be one of the biggest financial decisions of your life. Just like investing, looking to the long-term and focusing on your own personal circumstances and goals is key.

What are your thoughts about bonds?

Fixed income has gone a long way since the beginning of the year. Indeed, concerns over how far central bankers are willing to go to tame inflation and/or tighten financial conditions in an environment of slowing economic growth is increasingly being integrated by market participants – as are strong disruptions coming from the Ukraine-Russia conflict and the Chinese zero-Covid policies in terms of exchange, financial or confidence shock.

Nonetheless, such a sell-off should not be seen as a screaming buy opportunity for fixed income markets it shouldn’t either be viewed as dash for cash environment.

Central Bankers are facing a trilemma consisting of taming inflation, preserving employment, or avoiding financial shock. The conjunction of these 3 contradictory objectives should remain a source of volatility for sovereign rates. Even if rapidly pushing interest rates into restrictive territories aims at weighing on economic growth and ultimately weigh on inflation should relatively limit upward movements on long term interest rates.

For the credit market, the approach should be quite similar to equity markets. Slow growth, high inflation and high volatility on rates are detrimental to credit markets. However, at some point credit markets could be a good way to take a first step into risk assets, as valuations are pricing in quite a pessimistic outlook already (worse than equities). In the meantime, the approach should be largely based on bond picking.

Some opportunities could be interesting in sectors like energy and finance – issuers within both sectors have seen yields move up materially while the higher commodities prices environment and the higher rate environment are respectively viewed as positive criterion. It is quite telling to see that yields of several issuers in the energy space are currently at levels last seen in the midst of the COVID crisis when the price of oil was around $100 a barrel lower than today.

Could you recap Axelle's points on the 3 tips for responsible investing?

Sustainable investing, also known as socially responsible investing, is the process of incorporating environmental, social and governance (ESG) factors into investment decisions. Funds investing in companies with strong environmental, social and governance (ESG) policies have generally outperformed their benchmarks over recent years. Concretely, there are several ways of doing sustainable investing:

Exclusion: Eliminate exposures to companies or sectors that pose certain risks or violate an investor's values (ex: controversial weapons manufacturers, tobacco producers, thermal coal miners etc.).

Integration: Integrate environmental, social and corporate governance factors into the portfolio to improve returns and reduce risk.

Impact: Invest with the intention to generate measurable environmental and social impact, alongside a financial return.

In addition, Investors have a role to play as they can use their shareholder rights to drive companies to improve their governance, their carbon footprint and their human capital management. For instance, at Carmignac we engage with companies on several subjects like:

Climate change: we believe at Carmignac that every company must play its part in climate change mitigation. We work with the companies we invest in to achieve emissions transparency and climate friendly policies.

Empowerment: We believe employees are a company most valuable asset when care for. We ask the companies we invest in to focus on efficiently managing their human capital for employee engagement and satisfaction.

💖 I wanted to say a massive thank you to our speaker Axelle, you were brilliant! As well as our partners Carmignac.

I highly recommend you to listen to the episode we recorded with Maxime Carmignac a few weeks ago here and join us for our next quarterly update on September 20th (tickets are free!).

Carmignac is an independent asset management firm established in 1989 on three core principles that still stand true today: entrepreneurial spirit, human-driven insight and active commitment. We are as entrepreneurial today as we have always been; our team of fund managers keeping the freedom and courage to perform independent risk analysis, translate it into strong convictions and implement them. Our collaborative culture of debate, on-the-ground work and in-house research means we will always enhance data analysis with human-driven insight to better manage complexity and evaluate hidden risks.

We are both active managers and active partners, committed to our clients, providing transparency on our investment decisions and always be accountable for them. With a capital entirely held by the family and staff, Carmignac is now one of Europe’s leading asset managers, operating from 7 different offices. Today, as throughout our history, we are committed to try harder and better to actively manage our clients’ savings over the long-term.